Inventory Purchase Journal Entry Example

Proper accounting of raw materials is crucial as it directly impacts the cost of goods manufactured and, subsequently, the cost of goods sold (COGS). You will debit your COGS account and credit your inventory write-off expense account. However, if the amount of lost inventory is significantly high or reorder level of stock explanation formula example abnormally low, you can record the expenses as part of the COGS instead of accounting for them as an asset. Journal Entry for the Purchase of InventoryWhen inventory is purchased from a vendor, this is capitalized on the balance sheet in the Inventory account when title to that inventory is taken.

Actual loss is higher or lower than inventory reserve

This includes segregating duties among employees involved in inventory counts, calculations, and recording of adjustments. Establish an approval process where adjustments are reviewed and authorized by a supervisor or manager before being recorded in the accounting system. Sales records, such as invoices and sales receipts, provide information on the inventory sold during the period. This data is crucial for calculating the cost of goods sold (COGS) and for adjusting the inventory account to reflect the inventory that has been sold. The inventory related side of this transaction will be to remove the inventory and record the cost of goods sold expense. Notice that we are removing the final value that the inventory was on the books for in the example above, net of cash discount, at $700.

Physical Inventory Counts

Investing in inventory management software can significantly enhance inventory accuracy and efficiency. These software solutions offer features such as real-time tracking, automated reorder points, and detailed reporting capabilities. By using inventory management software, businesses can streamline their inventory processes, reduce manual errors, and gain valuable insights into inventory performance. This technology enables better decision-making and helps maintain optimal inventory levels. These are the unprocessed goods that a company buys to manufacture finished products. For example, in a furniture manufacturing business, raw materials would include wood, nails, and varnish.

- Both merchandising and manufacturing companies can benefit from perpetual inventory system.

- One of the features of the perpetual system is to provide the firm with information concerning its inventory levels.

- These systems reduce the likelihood of human error and provide accurate, up-to-date inventory information.

Is there any other context you can provide?

Finished goods are recorded at their production cost, which includes raw materials, labor, and overhead costs. Instead, the WIP inventory journal entry includes the total amount of raw materials that are necessary to produce a specific item because these costs of materials first appear at the start of the production process. The inventory system used by a business must be able to track multiple transactions as goods are received, stored, transformed into finished goods, and eventually sold to customers. A number of inventory journal entries are needed to document these transactions.

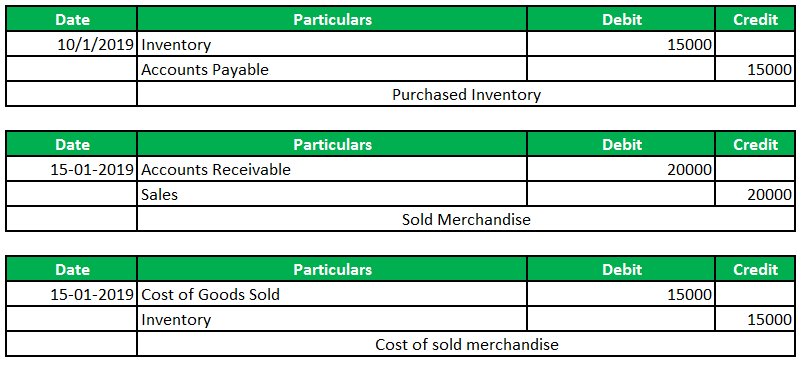

The money spent to acquire goods is added to an asset account called inventory and deducted as COGS (or manufactured) once those items are sold. Journal Entry for the Sale of InventoryOnce inventory is sold, then there are really two journal entries that must be booked. For example, on October 15, 2020, the company ABC Ltd. makes a $2,000 sale to one of its customers on credit.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. In conclusion, these differences and many others highlight that it is wiser and easier to use a perpetual inventory system. By contrast, recording every single transaction as soon as it takes place is tiresome and monotonous for bookkeepers under a perpetual system, and so computers and other devices are used. Let’s assume that a firm has started its year with a beginning inventory of pens costing $10,000. Consider a perpetual inventory system that is used in a post office warehouse, which ships and receives packages each day. This involves computing the cost of goods sold during the period and the appropriate cost of the ending inventory.

Instead, prior to the widespread use of computers, the Internet, and other digital technologies, it was common for a company to use a periodic inventory system. Let’s illustrate with examples for a company named “Garden Supplies Co.” that purchases inventory both in cash and on credit. Therefore, the ending net inventory balance is $100k, the value recognized on the current period balance sheet. In our hypothetical example, the “Inventory” account is adjusted by the debit entry of $20k, while the “Allowance for Obsolete Inventory” account reflects a credit balance of $20k.

The principle of conservatism establishes the guideline that revenue and assets can only be recognized when the probability of occurrence is near certain. There is no standard formula to apply for kind of inventory and business operation. However, management estimates may not be correct as they depend on historical data and experience. Depending on the size and complexity of the business, a reference number can be assigned to each transaction, and a note may be attached explaining the transaction. For example, the inventory cycle for your company could be 12 days in the ordering phase, 35 days as work in progress, and 20 days in finished goods and delivery.